does the irs write off tax debt after 10 years

Posted on Feb 26 2014. Under most circumstances it has 10 years from the assessment date to try to collect.

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

While most taxpayers receive a reprieve on their tax debt after ten years in some cases the IRS still has the ability to collect on an old debt.

. For example did you know that the IRS only has 10 years to collect on your tax debt. It does seem like ages ago but it applied to transactions in tax years 2007 to 2014. Creditors often write off debts after a set period of time for example one two or three years after you default.

The answer is that the IRS has 10 years to collect a debt after it is assessed. The IRS typically has 3 years after the initial assessment to tax audit whether you owe additional taxes for a particular tax year. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

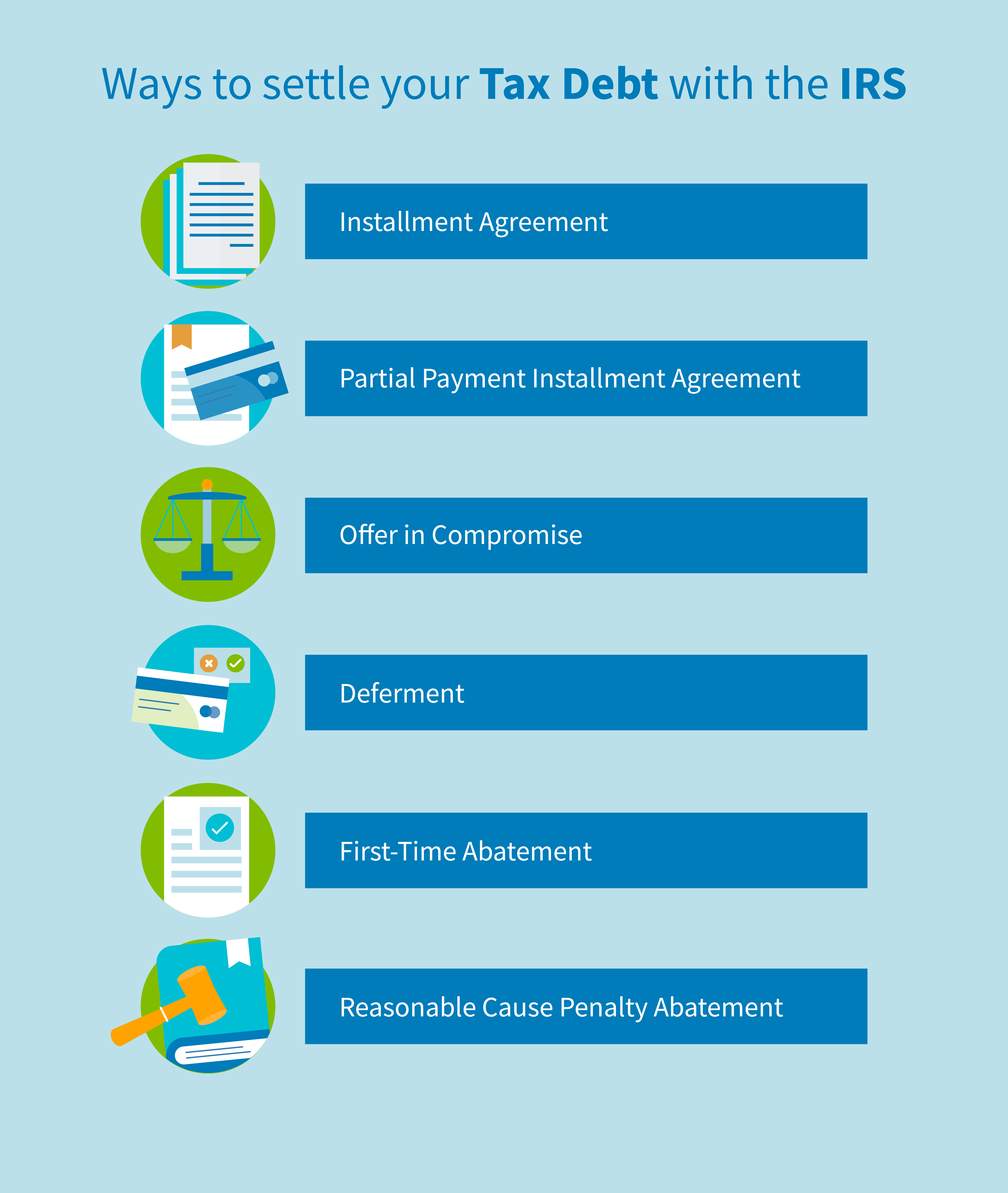

It allowed taxpayers to exclude from income debt write offs related to debt of their homes that. This is called an offer in compromise or. As already hinted at the statute of limitations on IRS debt is 10 years.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. All of that quiet debt does go eventually go away. You may take the deduction only in the year the debt becomes worthless.

Assessment starts the clock running on the ten years. After that it will vanish. This rule is against the interest of tax.

The 10 years starts at the debt of assessment which is. Do You ACTUALLY Qualify for Tax Settlement. The IRS refers to this as a Collection Statute Expiration Date Internally IRS.

Report a nonbusiness bad. Yes If Your Circumstances Fit. Specifically Internal Revenue Code 6502 Collection After Assessment limits the IRS to 10 years to collect a tax debt.

You dont have to wait until a debt is due to determine that its worthless. Ad Settle Tax Debts up to 99 Less. Has 10 years from the date that they assess the debt to collect it.

So take a look at the post above where we offer a flat fee. Honest Trusted Reliable Tax Services. Find out for Free.

So just how long does the IRS have to collect a debt. After the statute of limitation expires the uncollected tax debt older than 10 years is wiped from the IRSs books that means the IRS has to write it off. The IRS then has up to three years after accepting your return to assess the tax owed.

For example after filing your 2010 taxes in 2011. The creditor stops its collection efforts declares the debt. Its important for taxpayers to find out if their.

The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. Heres how it works. Talk to Trusted Tax Pro Now.

If they do not collect it within that 10. The IRS has 10 years to collect a tax debt. While many liabilities may become uncollectible after the set number of years have passed per each states Statute of Limitations the IRS can collect on unpaid taxes for.

Tax Bill Suprise For Old Debt The Irs Is Now On Your Side

Irs Collections What Is The Collection Process Next Steps To Take

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Are There Statute Of Limitations For Irs Collections Brotman Law

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Does Irs Debt Show On Your Credit Report H R Block

Back Tax Returns Tax Debt Advisors

Irs Tax Debt Relief Forgiveness On Taxes

Does Owing The Irs Affect Your Credit Score Community Tax

Does The Irs Forgive Tax Debt After 10 Years

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

How Long Can The Irs Try To Collect A Debt

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Does The Irs Forgive Tax Debt After 10 Years

Can The Irs Take Or Hold My Refund Yes H R Block

How To Get Out Of Tax Debt Credit Repair Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions